Bitcoin is a decentralized digital currency that was introduced in 2009. It challenges the traditional financial system and has made significant impact on the global economy.

It has experienced a decade of growth and milestones, marking the start of a new era of financial possibilities.

Key Takeaways

- Bitcoin’s introduction in 2009 marked the beginning of a decentralized digital currency revolution, with the concept of digital scarcity through blockchain technology.

- Despite initial skepticism and limited merchant adoption, Bitcoin has overcome challenges and grown to have a market capitalization in the hundreds of billions of dollars.

- Bitcoin exchanges have played a crucial role in facilitating widespread adoption and trading of the cryptocurrency, contributing to its liquidity and global reach.

- Regulatory hurdles and controversies surrounding Bitcoin’s decentralized nature have prompted discussions on global regulations, striking a balance between consumer protection and innovation.

Genesis: The Birth of Bitcoin

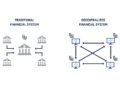

The birth of Bitcoin, marked by its creation in 2009, laid the foundation for a revolutionary digital currency that operates independently of any central authority. It all began with a white paper titled ‘Bitcoin: A Peer-to-Peer Electronic Cash System,’ authored by an individual or group using the pseudonym Satoshi Nakamoto. This enigmatic figure introduced the world to the concept of a decentralized, peer-to-peer electronic cash system that could potentially disrupt traditional financial institutions.

Satoshi Nakamoto’s invention sparked the cryptocurrency revolution, challenging the status quo and offering an alternative to the existing centralized financial system. Bitcoin, the first cryptocurrency, introduced the concept of digital scarcity through the use of blockchain technology. The blockchain acts as a public ledger, recording all transactions and ensuring transparency and security.

The birth of Bitcoin was met with skepticism and resistance from traditional financial institutions and governments. However, its immense potential in providing financial freedom and empowerment to individuals can’t be denied. Bitcoin has grown from a mere concept to a global phenomenon, with a market capitalization in the hundreds of billions of dollars.

The birth of Bitcoin is a testament to the power of innovation and the desire for financial freedom. It laid the groundwork for a new era of decentralized, borderless transactions, and its impact continues to shape the world of finance.

Early Adoption and Initial Challenges

Bitcoin’s early adoption and initial challenges played a crucial role in shaping its trajectory as a disruptive force in the financial world. One of the key challenges faced by Bitcoin in its early days was merchant adoption. Despite its potential to revolutionize payments, merchants were initially hesitant to accept Bitcoin as a form of payment. The lack of widespread adoption by merchants limited its use as a medium of exchange and hindered its growth.

Another significant challenge that Bitcoin faced was scalability issues. As the number of transactions increased, the Bitcoin network struggled to handle the growing demand. This led to delays in transaction confirmations and increased transaction fees, making it less attractive for everyday transactions. Scalability remains an ongoing challenge for Bitcoin, as its current transaction processing capacity is limited compared to traditional payment systems.

However, these challenges also paved the way for innovation and improvement. Over time, solutions such as the Lightning Network have emerged to address scalability issues and facilitate faster and cheaper transactions. Moreover, the gradual increase in merchant adoption has helped to legitimize Bitcoin as a viable payment option. Today, there are numerous businesses, both online and offline, that accept Bitcoin as a form of payment, further fueling its growth and acceptance.

Despite the initial challenges, Bitcoin’s resilience and adaptability have allowed it to overcome obstacles and continue its upward trajectory. The early hurdles it faced have contributed to its evolution as a disruptive force, challenging traditional financial systems and promising greater financial freedom for individuals around the world.

The Rise of Bitcoin Exchanges

After overcoming its early challenges, Bitcoin’s growth as a disruptive force in the financial world led to the rise of Bitcoin exchanges, which played a pivotal role in facilitating the widespread adoption and trading of the cryptocurrency. These exchanges have become the go-to platforms for buying and selling Bitcoin, offering users a convenient and secure way to participate in the digital currency market.

Here are some key aspects to consider:

- Market volatility: Impact on bitcoin exchanges.

Bitcoin’s value is known for its volatility, which can have a significant impact on exchanges. When the price of Bitcoin fluctuates rapidly, it can cause increased trading activity and higher transaction volumes on these platforms. Exchanges must be prepared to handle surges in demand, ensuring that their systems can handle the increased load without compromising security or causing disruptions.

- Security measures: Safeguarding transactions on bitcoin exchanges.

Bitcoin exchanges have made significant strides in enhancing the security of their platforms. They employ various measures such as two-factor authentication, encryption protocols, and cold storage for holding user funds offline. Furthermore, exchanges are constantly monitoring for suspicious activities and implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to prevent illicit transactions.

- User-friendly interfaces: Simplifying the trading experience.

Bitcoin exchanges have evolved to provide user-friendly interfaces that make it easy for individuals to buy, sell, and trade Bitcoin. They offer features such as real-time market data, order books, and trading charts, empowering users to make informed decisions. Additionally, many exchanges provide mobile apps, allowing users to access their accounts on the go.

- Liquidity and global reach: Expanding Bitcoin’s accessibility.

Bitcoin exchanges have contributed to the liquidity of the cryptocurrency market by providing a platform for buyers and sellers to interact. These exchanges operate globally, enabling individuals from different countries to trade Bitcoin easily. The ability to exchange Bitcoin for fiat currencies has also facilitated its integration into the traditional financial system.

Bitcoin exchanges have revolutionized the way people engage with Bitcoin, making it more accessible, secure, and user-friendly. As the market continues to evolve, these platforms will play a crucial role in the future growth and adoption of the cryptocurrency.

Regulatory Hurdles and Controversies

Bitcoin exchanges have faced numerous regulatory hurdles and controversies as the cryptocurrency has gained mainstream attention and scrutiny from governments and financial institutions. The decentralized nature of Bitcoin challenges traditional regulatory frameworks, leading to government restrictions and legal implications. Here is a table summarizing some of the key regulatory hurdles and controversies faced by Bitcoin exchanges:

| Year | Event | Impact |

|---|---|---|

| 2011 | Mt. Gox Hack | The biggest Bitcoin exchange at the time, Mt. Gox, suffered a massive security breach, resulting in the loss of over 850,000 bitcoins. This incident highlighted the need for improved security measures and regulatory oversight of exchanges. |

| 2013 | Silk Road Shutdown | The Silk Road, an online marketplace notorious for facilitating illegal activities using Bitcoin, was shut down by the FBI. This event raised concerns about Bitcoin’s association with illegal activities and prompted increased scrutiny from regulators. |

| 2017 | China Bans ICOs | China banned Initial Coin Offerings (ICOs), causing a significant drop in Bitcoin’s price. This move highlighted the role of governments in regulating cryptocurrency fundraising methods and led to increased global discussions on ICO regulations. |

These events demonstrate the complex relationship between Bitcoin exchanges and regulators. While governments aim to protect consumers and combat illicit activities, they must balance these objectives with the desire for economic freedom and innovation. As Bitcoin continues to evolve, it is likely that further regulatory challenges and controversies will arise, shaping the future of the cryptocurrency industry.

Mainstream Acceptance and Future Outlook

The increasing integration of Bitcoin into mainstream financial systems and the growing interest from institutional investors point to a promising future for the cryptocurrency. As Bitcoin continues to gain acceptance and recognition, it faces several challenges in achieving mainstream adoption. These challenges include regulatory hurdles, scalability issues, and the need for enhanced security measures.

Despite these obstacles, the potential market impact of Bitcoin can’t be ignored. Here are four key factors that contribute to its future outlook:

- Increasing institutional involvement: The entry of institutional investors into the cryptocurrency market brings legitimacy and stability. Their participation not only attracts more investors but also contributes to the overall growth of the market.

- Technological advancements: Bitcoin’s underlying technology, blockchain, has the potential to revolutionize various industries. As blockchain applications continue to evolve and improve, they’ll drive the adoption of Bitcoin and other cryptocurrencies.

- Global economic uncertainties: Bitcoin’s decentralized nature and limited supply make it an attractive alternative investment during times of economic instability. As governments and central banks struggle to address economic challenges, Bitcoin’s value as a hedge against inflation and currency devaluation continues to grow.

- Evolving regulatory landscape: While regulatory challenges exist, governments are also recognizing the need to establish clear guidelines for the cryptocurrency industry. As regulations become more defined, they’ll provide a framework for the mainstream acceptance of Bitcoin.

Frequently Asked Questions

What Is the Current Price of Bitcoin?

What’s the current price of Bitcoin? Are you curious about its value in the market? Bitcoin’s impact on the global economy is undeniable, and staying informed about the current market trends is essential for financial freedom.

How Can I Buy and Sell Bitcoin?

To buy and sell bitcoin, you have various options. You can use online platforms like Coinbase or Binance, which offer easy access to the cryptocurrency market. These platforms allow you to buy and sell bitcoin with ease.

What Are the Potential Risks and Security Concerns Associated With Bitcoin?

When it comes to potential risks and security concerns with Bitcoin, you need to consider the possibility of government regulation and the scalability issues that the cryptocurrency faces. Stay informed and be cautious.

Can Bitcoin Be Used for Illegal Activities?

Yes, Bitcoin can be used for illegal activities due to its pseudo-anonymous nature. This has raised concerns about its role in money laundering. The future of Bitcoin regulation will play a crucial role in addressing these risks and ensuring a secure environment for users.

How Does Bitcoin Mining Work and Why Is It Important for the Network?

Want to understand how Bitcoin mining works and why it’s crucial for the network? It’s all about the mining process and the hardware requirements. Get ready to dive into the fascinating world of Bitcoin mining.