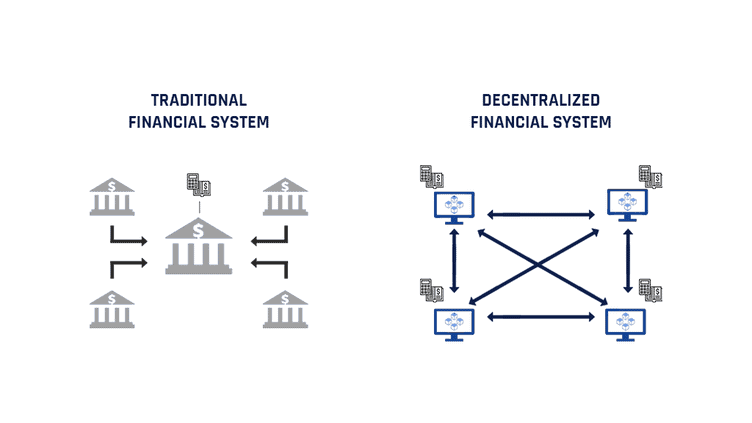

Decentralized Finance (DeFi) refers to the digital financial ecosystem where traditional financial systems are replaced by blockchain technology, fostering a decentralized network of trust and transparency.

In the cryptocurrency world, DeFi is revolutionizing the way we interact with money by offering potential benefits and challenges that could shape the future of finance.

Key Takeaways

- DeFi allows individuals to have control over their financial transactions without intermediaries, promoting financial inclusion.

- Blockchain technology provides transparency, trust, and security in DeFi by recording transactions on a decentralized and immutable ledger.

- Smart contracts automate and enforce agreements in DeFi, reducing costs and increasing efficiency.

- DeFi has the potential to disrupt traditional banking, increase financial inclusion, reduce costs, and reshape the financial landscape, but it also faces challenges such as scalability, regulatory obstacles, and security risks.

What Is Defi?

Defi, short for decentralized finance, is a revolutionary concept that allows individuals to have full control over their financial transactions without the need for intermediaries such as banks or traditional financial institutions. In the world of cryptocurrency, decentralized finance applications, also known as Defi protocols, have gained significant popularity. These applications are built on blockchain technology and enable users to access a wide range of financial services, such as lending, borrowing, trading, and investment, all in a decentralized and transparent manner.

One of the key advantages of Defi is its ability to eliminate the need for intermediaries. By leveraging blockchain technology, Defi protocols enable direct peer-to-peer transactions, cutting out the middleman and reducing costs. This not only empowers individuals by providing them with direct control over their finances but also opens up opportunities for financial inclusion, as anyone with an internet connection can participate in Defi applications.

Furthermore, Defi protocols offer a high degree of transparency and security. All transactions and activities are recorded on the blockchain, making them immutable and auditable by anyone. This ensures that the system is tamper-proof and reduces the risk of fraud or manipulation.

The Role of Blockchain in DeFi

Blockchain plays a crucial role in DeFi by providing an immutable ledger that ensures transparency and trust in financial transactions.

Through the use of smart contracts, DeFi applications can automate and enforce the terms of agreements, eliminating the need for intermediaries and reducing costs.

With blockchain’s decentralized nature, it enables users to have full control and ownership of their assets, creating a more inclusive and accessible financial system.

Blockchain’s Immutable Ledger

The use of blockchain technology in the world of decentralized finance (DeFi) has revolutionized the concept of an immutable ledger. Blockchain, the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, provides a decentralized and transparent system for recording and verifying transactions. This immutable recordkeeping feature of blockchain ensures that once a transaction is recorded, it cannot be altered or tampered with, ensuring the integrity and security of financial data.

| Advantages of Blockchain’s Immutable Ledger | Disadvantages of Blockchain’s Immutable Ledger |

|---|---|

| Transparency and trust | Scalability challenges |

| Enhanced security and privacy | Energy consumption concerns |

| Elimination of intermediaries | Potential for regulatory hurdles |

With an immutable ledger, individuals have greater control over their financial transactions, eliminating the need for intermediaries like banks. This empowers individuals with financial freedom and opens up new opportunities for innovation in the DeFi space. However, it’s important to address the scalability challenges and energy consumption concerns associated with blockchain technology to ensure its long-term sustainability.

Transparency in DeFi

After understanding the advantages and disadvantages of blockchain’s immutable ledger, it’s significant to explore the role of blockchain in ensuring transparency in DeFi.

Transparency is one of the key advantages of DeFi, as it allows users to verify transactions and track the movement of funds on the blockchain. Blockchain technology provides a decentralized and immutable record of all transactions, making it difficult for any party to manipulate or alter the data.

This transparency enables users to conduct audits and verify the legitimacy of DeFi protocols and smart contracts. The ability to audit DeFi platforms ensures that they’re operating as intended and that the funds are being used properly.

As a result, users can have confidence in the integrity of the system, promoting trust and security in the decentralized finance ecosystem.

Smart Contracts and DeFi

Smart contracts play a crucial role in the decentralized finance (DeFi) ecosystem by enabling automated and trustless transactions on the blockchain. These self-executing contracts eliminate the need for intermediaries, reducing costs and increasing efficiency.

However, the scalability of smart contracts remains a challenge in the DeFi space. As the number of users and transactions on the blockchain increases, it puts a strain on the network, causing delays and higher fees. To address this, developers are exploring various solutions, such as layer 2 protocols and sidechains, to improve scalability without compromising security.

Additionally, regulatory challenges in DeFi pose another obstacle. Governments and regulatory bodies are grappling with how to regulate this decentralized and global financial system. Striking a balance between protecting investors and promoting innovation is crucial for the continued growth of DeFi.

Benefits of Decentralized Finance

One of the key advantages of decentralized finance (DeFi) is its ability to provide individuals with greater control over their financial transactions and assets. With DeFi, you have the power to manage your finances without relying on intermediaries like banks or financial institutions. This not only eliminates the need for third-party involvement but also reduces the associated costs and fees.

Decentralized finance offers numerous opportunities for individuals to access financial services that were previously unavailable or limited to a select few. It enables anyone with an internet connection to participate in various financial activities, such as lending, borrowing, trading, and investing, regardless of their geographic location or socioeconomic status.

Moreover, DeFi operates on transparent and immutable blockchain technology, which ensures the integrity and security of transactions. This eliminates the risk of fraud or manipulation often associated with centralized systems. Additionally, smart contracts, a key component of DeFi, automatically execute transactions based on predetermined conditions, removing the need for intermediaries and reducing the potential for human error.

Furthermore, decentralized finance promotes financial inclusivity by eliminating the reliance on traditional banking systems, which may exclude individuals without access to banking services. DeFi allows for borderless transactions, making it easier and more affordable to send and receive money internationally.

Key Players in the DeFi Ecosystem

Decentralized finance (DeFi) has rapidly gained popularity in the cryptocurrency world, with various key players emerging to drive innovation and shape the future of this ecosystem.

Here are four key players in the DeFi ecosystem that are revolutionizing the way we interact with financial services:

- DeFi liquidity providers: These are individuals or entities that contribute liquidity to DeFi platforms by lending their cryptocurrency assets. By doing so, they enable users to borrow and trade assets, fostering greater liquidity and efficiency in the DeFi space.

- DeFi lending platforms: These platforms allow users to lend and borrow cryptocurrencies without the need for intermediaries. They leverage smart contracts to automate the lending process, ensuring transparency and security. DeFi lending platforms empower individuals to access capital or earn interest on their assets, without the traditional barriers imposed by centralized financial institutions.

- Decentralized exchanges (DEXs): DEXs facilitate peer-to-peer trading of cryptocurrencies, eliminating the need for intermediaries and centralized order books. They provide users with greater control over their assets and reduce the risk of hacks or theft associated with centralized exchanges.

- Stablecoin issuers: Stablecoins are cryptocurrencies that are pegged to a stable asset, such as the US dollar. They provide a stable store of value and are widely used in DeFi applications for trading, borrowing, and lending. Stablecoin issuers play a crucial role in maintaining price stability and ensuring the reliability of decentralized financial services.

These key players are driving the decentralization of finance, empowering individuals with greater financial freedom and autonomy. With their continued innovation and adoption, the future of DeFi looks promising and full of potential.

Exploring DeFi Use Cases

Now let’s explore the use cases of DeFi in the cryptocurrency world.

DeFi adoption trends have been on the rise as individuals and institutions recognize its potential to revolutionize traditional finance.

By eliminating the need for intermediaries, DeFi has the power to democratize access to financial services and empower individuals to take control of their own finances.

Additionally, DeFi’s impact on finance extends beyond accessibility, with the potential to improve efficiency, transparency, and security in various financial processes.

Defi Adoption Trends

Examining the various use cases of DeFi reveals the growing trends in its adoption within the cryptocurrency world. Here are four key trends that highlight the increasing popularity and potential of DeFi:

- Rising demand for decentralized lending and borrowing platforms, enabling individuals to access loans without relying on banks or intermediaries. This empowers users with greater financial freedom and control over their assets.

- Increased interest in decentralized exchanges (DEXs), which allow users to trade cryptocurrencies directly with one another without the need for intermediaries. DEXs offer enhanced privacy, security, and transparency compared to centralized exchanges.

- Growing adoption of stablecoins, which are cryptocurrencies pegged to real-world assets or fiat currencies. Stablecoins provide stability and enable seamless transactions within the DeFi ecosystem.

- The emergence of yield farming and liquidity mining, where users can earn rewards by providing liquidity to DeFi protocols. This incentivizes participation and encourages the growth of the DeFi ecosystem.

These trends highlight the potential of DeFi to revolutionize traditional finance by democratizing access to financial services and creating a more inclusive and decentralized financial system.

While challenges remain, such as scalability and regulatory concerns, various strategies, such as interoperability and regulatory compliance, are being explored to facilitate wider adoption of DeFi.

Defi’s Impact on Finance

As DeFi adoption continues to grow within the cryptocurrency world, its impact on finance becomes increasingly evident through the exploration of various use cases.

One of the key areas where DeFi is disrupting traditional finance is in its impact on traditional banking. DeFi eliminates the need for intermediaries like banks by allowing users to directly interact with financial services through smart contracts on the blockchain. This decentralization of financial services not only reduces costs but also increases efficiency and transparency.

Additionally, DeFi plays a crucial role in financial inclusion. By providing access to financial services to the unbanked and underbanked populations, DeFi is empowering individuals who’ve been excluded from the traditional banking system. This inclusive nature of DeFi has the potential to reshape the financial landscape and provide financial freedom to those who need it the most.

Challenges and Risks of DeFi

What are the main challenges and risks associated with DeFi in the cryptocurrency world?

Here are the key risks to consider when engaging with decentralized finance:

- Smart Contract Vulnerabilities: DeFi relies heavily on smart contracts to automate processes and execute transactions. However, these contracts aren’t immune to bugs, coding errors, or malicious attacks. Exploiting vulnerabilities in smart contracts can lead to significant financial losses for users.

- Lack of Regulation: The decentralized nature of DeFi means that it operates outside the traditional regulatory framework. While this offers freedom and autonomy, it also exposes users to potential risks such as scams, fraud, and market manipulation. Without proper oversight, it becomes challenging to hold bad actors accountable.

- Impermanent Loss: Liquidity providers in DeFi platforms face the risk of impermanent loss. This occurs when the value of the underlying assets changes while providing liquidity, resulting in a loss compared to simply holding the assets. Market volatility can amplify this risk, impacting the overall profitability of participating in DeFi.

- Centralized Points of Failure: Despite the aim of decentralization, many DeFi platforms still rely on centralized components, such as oracles, wallets, and exchanges. These centralized points of failure introduce vulnerabilities and potential risks, as they can be targeted by hackers or manipulated to influence the outcomes of DeFi transactions.

To mitigate these risks, it’s crucial to implement robust security measures, conduct thorough due diligence on projects and protocols, and diversify investments to minimize potential losses. Remember, while DeFi offers exciting opportunities, it’s essential to navigate the risks with caution and make informed decisions.

The Future of Decentralized Finance

The future of decentralized finance holds immense potential for revolutionizing the way you interact with financial systems and services. As decentralized finance (DeFi) continues to grow and mature, it is expected to have a significant impact on traditional banking and financial institutions.

One of the key implications of DeFi is its potential to disrupt the traditional banking sector. By eliminating intermediaries and enabling direct peer-to-peer transactions, DeFi can provide individuals with greater control over their finances and reduce reliance on traditional banking services. This can lead to increased financial inclusivity, especially for the unbanked population.

However, the growth of DeFi also raises concerns regarding regulation and compliance. As DeFi operates on a decentralized and permissionless network, it challenges the existing regulatory frameworks that are designed for centralized financial systems. Regulators are still grappling with how to effectively regulate DeFi while ensuring consumer protection and preventing illicit activities.

To understand the potential impact of DeFi on traditional banking and the challenges of regulation and compliance, let’s take a look at the following table:

| Impact on Traditional Banking | Regulation and Compliance in DeFi |

|---|---|

| Disruption of intermediaries and traditional banking services | Lack of clear regulatory framework |

| Increased financial inclusivity | Concerns about consumer protection |

| Reduced fees and transaction costs | Potential for illicit activities |

| Greater financial control for individuals | Need for collaboration between regulators and DeFi projects |

The future of decentralized finance holds exciting possibilities, but it also presents challenges that need to be addressed. As DeFi continues to evolve, it is crucial for regulators, policymakers, and industry participants to work together to create a balanced regulatory environment that fosters innovation while protecting users and ensuring compliance.

Frequently Asked Questions

Are There Any Regulatory Frameworks in Place for Decentralized Finance?

There aren’t any regulatory frameworks in place for decentralized finance, which poses regulatory challenges and compliance requirements. However, this lack of regulation also offers freedom and opportunities for innovation in the cryptocurrency world.

How Can I Participate in Decentralized Finance if I Don’t Have Any Cryptocurrency?

Want to join the DeFi revolution but don’t have any crypto? No worries! You can still participate by investing in DeFi without owning cryptocurrency. Let me show you how to unlock financial freedom.

What Are the Potential Security Risks Associated With Using Decentralized Finance Platforms?

When using decentralized finance platforms, you should be aware of potential security risks. Smart contract vulnerabilities can expose your funds to hackers, and there is a potential for fraudulent activities due to the lack of centralized regulation. Stay vigilant and do thorough research.

Can Decentralized Finance Be Used for Traditional Financial Activities Like Lending and Borrowing?

You can definitely use decentralized finance for traditional financial activities like lending and borrowing. It offers advantages such as transparency and accessibility, but be aware of the potential risks involved.

Is There a Limit to the Scalability of Decentralized Finance Platforms?

There are scalability challenges in decentralized finance platforms, but future solutions are being developed to address them. It’s important to consider these limitations when exploring the potential of DeFi for financial freedom.